Sisyphus Market

- MAC10

- Jun 29, 2025

- 2 min read

"In Greek mythology, King Sisyphus reveals Zeus's abduction of Aegina to the river god Asopus, thereby incurring Zeus's wrath. As his punishment he is forced to roll an immense boulder up a hill only for it to roll back down every time it nears the top"

To begin, here is the primary narrative of the stock market circa 2025:

A generation approaches retirement and therefore mindlessly plows every available dime into the stock market regardless of record over-valuation. The money has to go somewhere so Wall Street happily recycles the "Artificial Intelligence" narrative that has been the recurring theme of computing since the invention of computers seven decades ago. The overriding goal is to destroy all remaining jobs in order to achieve early "retirement". The key fact that robots don't shop, they don't travel, and they don't spend any money, doesn't throw into question the narrative that they will soon be doing all of the work. No one questions the jobless economy hypothesis.

Of course Silicon Valley happily deploys record capital to massively under-utilized data centers, amid the widely known fact there is no actual final demand for the massive increase in computing capacity. The largest Tech supplier approaches $4 trillion valuation and the market reaches new highs on collapsed breadth while the economy implodes in real time.

That is the story as to how we got here. In the following charts I will show the market highlights of first half 2025:

First off, here we see the market cap weighted semiconductor index has gone nowhere for the past year, while crashing twice.

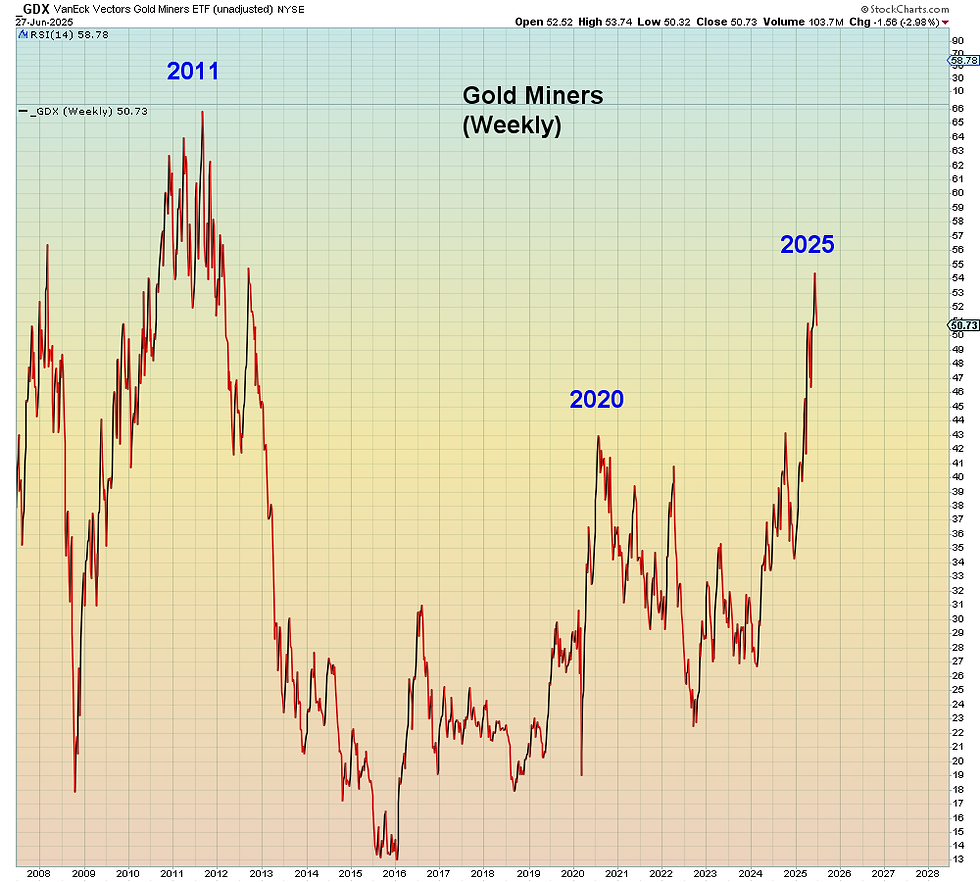

The top performing (single-leveraged U.S.) stocks year-to-date are gold and silver stocks. These have been rallying due to trade war inflation fears. However, they are beginning to roll over as the first half comes to a close.

The second top performing sector year-to-date are Platinum stocks which are eerily similar to the 2021 Gamestop Moment which I wrote about in my last blog post.

Vying for the 3rd top ETF position are Crypto stocks, Video Game stocks, and the Ark ETFs.

The fact that Cathie Wood is back in the news after a four year hiatus, doesn't seem to be raising any alarm bells among financial pundits. They got fooled last time so why not get fooled all over again, appears to be the standard line of thinking.

Many individual stocks had parabolic moves in the first half. However, among the larger cap single stocks which performed best in the first half, below are best known top performers:

Palantir became a meme stock in 2025. Here we see it collapsed already once in the first quarter and it's imploding again now at the end of the second quarter.

Shocking?

Netflix is the top performing "FANG" stock year-to-date:

The last chart is the leading Crypto stock Coinbase, which has now round-tripped back to the 2021 highs.

Bullish we are told. Again.