Bear Market As Usual

- MAC10

- May 6, 2025

- 3 min read

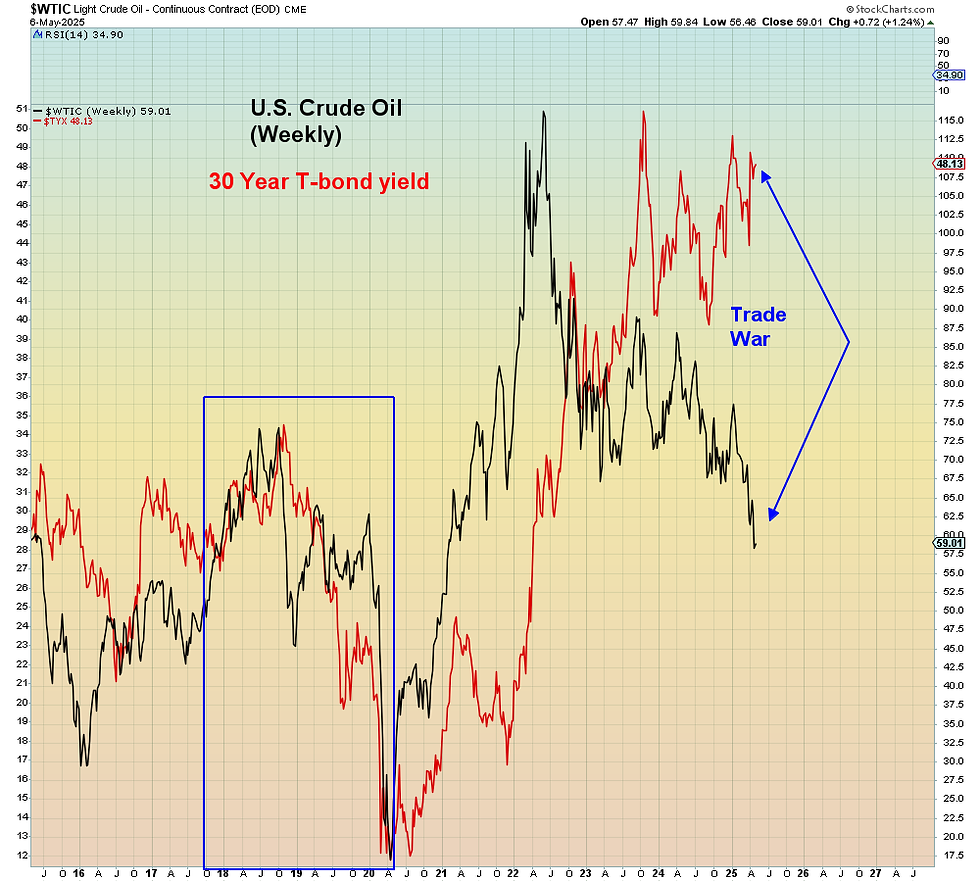

The path of this bear market is eerily following the 2022 pattern except it has been even more volatile and on higher volume. How deep and painful this bear market ultimately becomes depends entirely upon Trump. Position accordingly.

"(Bloomberg) — The steep recovery in equity markets over the past two weeks is typical of bear market rallies"

Trump's first 100 days were the worst start for a presidential term since Nixon's second term started in 1973. Back then the market continued lower into a very nasty (-45%) ~two year bear market that bottomed in 1974 culminating with Nixon's impeachment and resignation due to the Watergate scandal.

I show the S&P 100 because it contains the largest cap stocks and it has a very symmetrical head and shoulders top.

Continuing from the above article:

“If the tariff announcements are reversed quickly with little lasting economic damage, this does suggest that the downside risks are limited. Nonetheless, at current valuations, we also think the upside is limited”

As I pointed out on Twitter, Trump has a very limited window to declare "victory" on his trade war with China and then de-escalate. The FOMC meets tomorrow and rate cut odds have been declining since this stock market rebound began. This article gives an excellent summary of the game theory playing out between Trump and China. Trump is in a big hurry to wrap up this trade war and declare victory, whereas the Chinese are not in a hurry, contrary to what the Trump Administration would like to believe. They are still evaluating the possibility of talks:

"One of the major asks of China will be for tariffs to go back to pre-'liberation day' levels, at least during the negotiation period. Such a move could provide significant relief to businesses on both sides; however, it remains uncertain how receptive the Trump administration would be to this proposal,"

Today (May 6th, 2025) Treasury Secretary Bessent just confirmed that the two sides are STILL not talking. Recall that Trump's original reciprocal tariff on China was a cumulative 54% (20% + 34%). So that is very likely Trump's line in the sand below which he would be viewed as capitulating, which means the two sides are very far apart on where to start and further still from the current 145% level. Therefore the asymmetry of returns is skewed heavily to the downside. As the article above states, in the (unlikely) event the China tariffs are quickly lowered to pre-Liberation day level (20%) then the market could squeeze back to all time highs. However, if the two sides drag this out then the market will retest the lows on likely higher volume and volatility than last time.

Pundits are unwilling to admit that Tech is a broken trade now. The AI super bubble has been popped by the exodus out of U.S. assets and the various export restrictions now being placed on technology by both sides. AI is at the epicenter of the trade war.

One by one the former leading Tech stocks are rolling over at lower highs. The most recent spectacular example being Palantir which had a great quarter but the stock still exploded at the prior high today:

In summary, this continues to be a trader's market now. There continues to be high volatility in both directions which gives nimble traders a chance to put positions on in their favored direction and then scalp for profit. Those traders who are waiting for a big directional move one way or another are getting frustrated. Nevertheless, as we re-approach the bottom of the range, the likelihood of a major downside dislocation will increase commensurately. A major break of the April low on high volume will quickly render all of today's rosy predictions for a quick resolution to this trade war totally irrelevant. At that point, global markets will become the catalyst for recession, not the trade war. Trump will have lost control over his "Crazy Ivan" strategy which has caused extreme market volatility.

"Mark Pocan, took Bessent to task on tariffs Tuesday, repeatedly asking Bessent who pays for the president’s tariffs"

"I compare them to how a monkey throws dung. You're not exactly sure where they're gonna land"

A monkey throwing dung indeed.