FOMC: Fear of Missing Crash

- MAC10

- Sep 17, 2025

- 3 min read

It's Trump's bad fortune that he was elected at the end of the cycle. But then he went and made it far worse by starting a trade war. Now tariff inflation is masking the true underlying weakness in the economy.

The Fed is confounded. Today they cut rates 1/4 point but then admitted that inflation is above their target and likely to continue rising, meanwhile the job market is weakening markedly - the worst case scenario for a central bank - their dual mandate calls for contradictory policy. Absent tariff inflation, the Fed would have been panic cutting rates .5% and promising many more large rate cuts to come. But they can't. Yet.

Historically, the Fed has caused every natural recession since WWII by raising rates at the end of the cycle and holding them high until inflation pressures diminish. I say natural recession because the pandemic for example was an exogenous shock versus a standard "Minsky" recession wherein debt accumulates until it spontaneously explodes due to rate hikes.

Many pundits are now claiming that rate cuts at all time highs are bullish for stocks. However, I created this chart below going back 30 years which shows that the record is mixed at best and catastrophic at worst. The last rate cut was a year ago and indeed the market is higher today, but there was a -20% crash earlier this year. The next most recent rate cut was in June 2019 which was followed nine months later by the pandemic crash -35% (albeit not due to the rate cut). A year later in June 2020 the market was breakeven but heading higher on record global stimulus. Further back we see that both 2007 and Y2K rate cuts were a disaster for markets - whether due to causation or correlation to economic collapse it doesn't matter. Both times stocks were lower a year later and the final bottom was much lower. I am guessing that pundits who see imaginary stock gains from rate cuts are measuring gains not after the FIRST rate cut but after the LAST rate cut which as we see below makes a huge difference to markets.

One is buying the top and the other is buying the bottom. I recommend the latter. Buy stocks when rates are back at 0%.

After the FOMC decision was released at 2pm, stocks initially lurched higher but then they exploded lower before bouncing to end the day near breakeven. It was a wild ride, however there is reason to believe it was just the start of the return of volatility because this week is quarterly options expiration which means it's highly possible that the market will finally break out of the "zombie" rate cutting mode that has been in place since the Jackson Hole meeting in August:

September's 'triple witching' options expiration is set for Friday. It is one of a host of derivatives-market developments that investors should probably keep an eye on.

Triple-witching events have in the past been associated with major turning points in markets"

On the topic of options positioning below we see that the ISEE call/put ratio was the highest since February - three days in a row, including today (Wednesday). All of these soon to expire call options are pinning the market higher. For now.

From a breadth standpoint, this rally was never very convincing. Many pundits inform us that rate cuts benefit small cap stocks more than large cap stocks. We saw that today when the Russell 2000 was up 2% and the Nasdaq was negative. However, below we see that small caps STILL haven't confirmed this new all time high. And they remain below the level first hit back in 2021. Not exactly confirming the rate cutting hypothesis benefiting economy sensitive stocks:

Even within the Nasdaq 100, breadth is no better than it was back in April just prior to the crash:

Nasdaq new highs, not confirming AI mania:

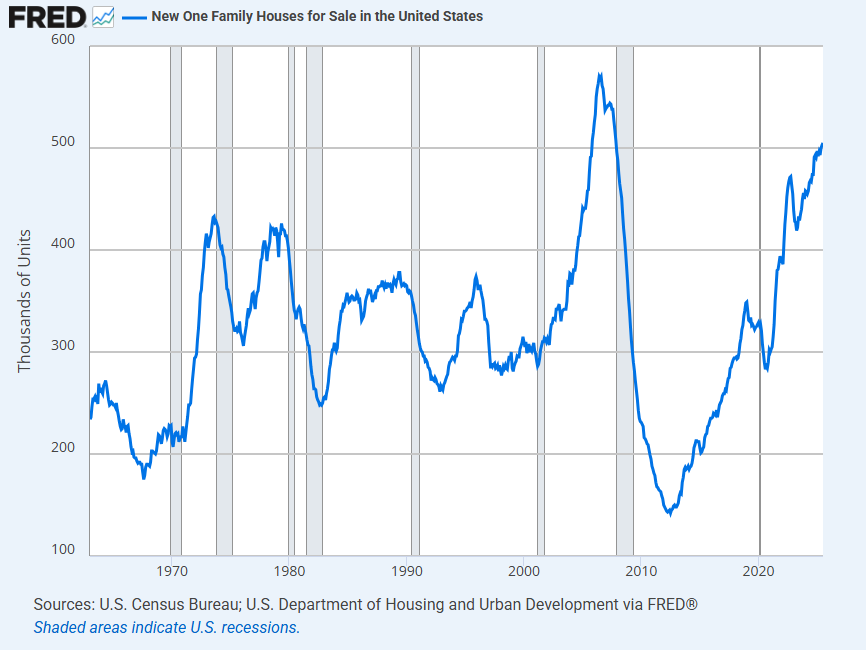

One thing Powell said during his press briefing is that these next few rate cuts will not be enough to help the ailing housing market.

"The report from the Commerce Department on Wednesday also showed permits for future single-family home construction dropped last month to the lowest level in more than two years. Some economists said the decline was necessary to manage new housing inventory, currently near levels last seen in late 2007."

In summary, it's the end of the cycle. The Fed is paralyzed by the rise of inflation in a weakening economy - as they alway are at the end of the cycle. Meanwhile, Trump keeps everyone in the casino by telling them that this is the greatest economy in U.S. history.

We all suffer the consequences of the lies we believe.