Central Bank Extravaganza

- MAC10

- Jan 22, 2024

- 2 min read

The goal of central banks over these next two weeks will be to close the "gap" between fantasy and reality:

Weekend Barron's Magazine:

"By the end of the (last) week, the chances of a March rate cut—the one that had gotten investors so excited—had dropped to 52%, down from 79%"

It could have been the end of the world for the stock market—and at first, it looked like it might be, with the S&P 500 dropping 1.1% during the first two days of the week. By Friday, however, the index had gained 1.2% for the week and closed at a record high"

"The market is starting to price in more economic growth and fewer cuts"

FR: It's the immaculate rotation from rate cuts to faster growth, but if that is true, then why is Tech making new highs while cyclical stocks are lagging? Semiconductors are the cyclicals of Tech so this explains why those stocks are getting bought with both hands. They can be both reflationary and deflationary.

Another article from Barron's this past weekend explaining that the Fed needs to close this chasmic gap between rate cut expectations and rate cut reality. We have now entered the FOMC silent period which means that it will be up to Powell next week to talk markets back down to reality. Something he has been forced to do several times over the past two years.

"The task before the next Federal Open Market Committee meeting will be to reconcile the yawning gap between market expectations for interest-rate cuts and the panel’s own projections for policy for 2024"

"failing to lower the fed-funds rate would amount to an inadvertent tightening from the rise in the real (inflation-adjusted) rate as the pace of price increases wanes. Yet the specter of too-tight policy is belied by the marked easing in financial conditions in recent months"

As we see below, this rally has brought financial conditions back to where they were when the Fed started tightening. Front-running of rate cuts has essentially unwound the Fed rate hikes from a financial conditions standpoint.

Tonight (Tuesday) in Japan, the BOJ is widely expected to keep interest rates at the short-end unchanged at negative -.10%. Many pundits believe that the BOJ will never raise rates at the short-end, despite the fact that the BOJ has been allowing rates to rise on the long-end for over a year now. This belief of course conveniently feeds back into the ever-increasing Yen carry trade which were it to inconveniently unwind would surely complicate central bank bailout plans.

Over in Europe ECB Chief Christine Lagarde has also been busy resetting rate cut expectations.

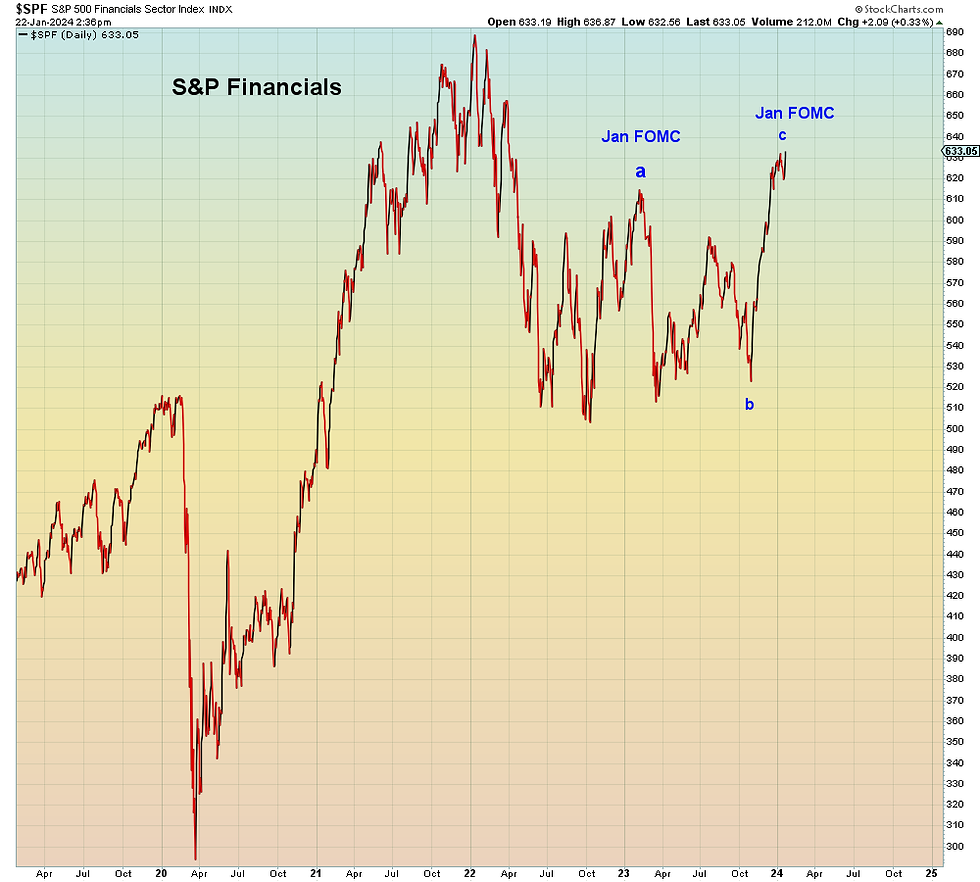

In summary, S&P Financial stocks have now round-tripped back to where they were last January when hawkish Powell sparked a bank run.